Malaysia is on a strong digital trajectory, moving towards the global digitalization goal. It is not difficult to recognize one of the typical actions that demonstrate this goal of the Malaysian government: requiring all businesses of all sizes to conduct e-invoicing Malaysia. Different time frames will be applied to each type of business, with the final deadline being July 2025.

According to the Ministry of Finance (MOF), as of 14 October 2024, a total of 7,400 companies have successfully applied the e-invoice system and more than 58 million e-invoices have been issued. Clearly, businesses have gradually realized the value of this transition, although there are certainly still challenges and difficulties.

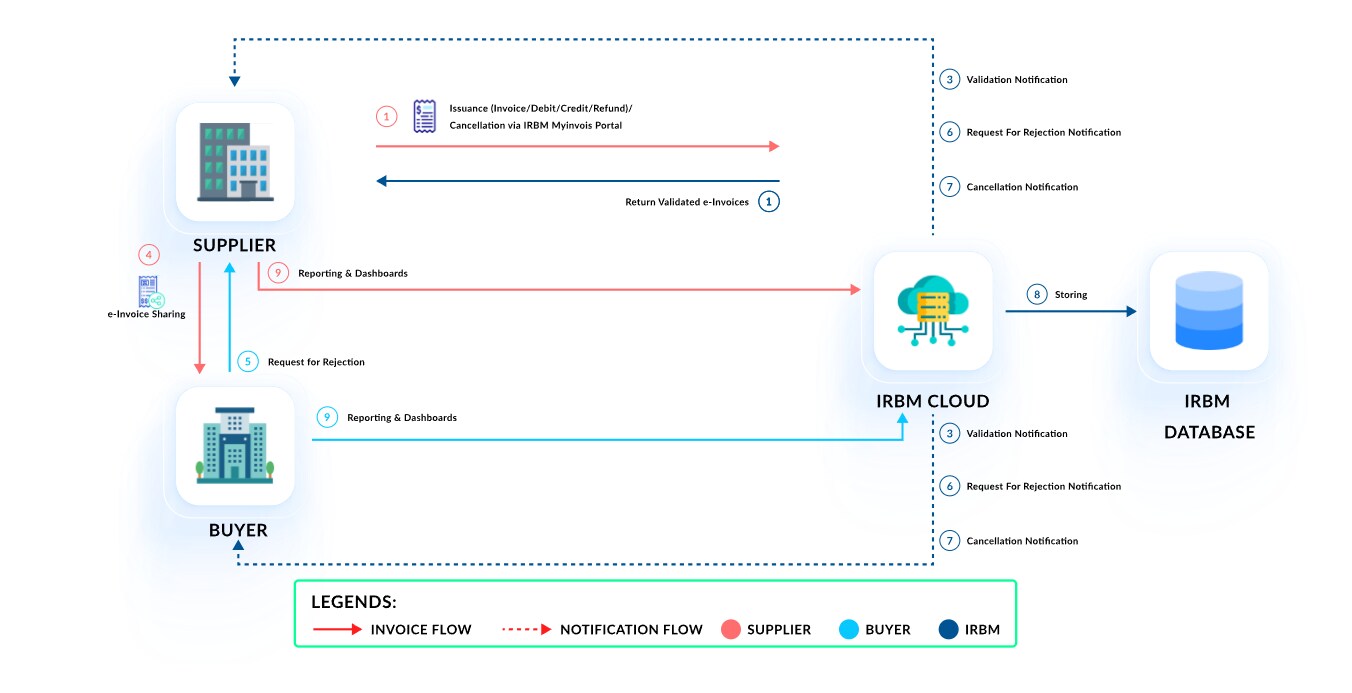

The core of the e-invoicing system in the Malaysian market lies in the power of APIs - the key to seamless e-invoicing experience. A strong statement that should make you want to learn about e invoicing API right away: it connects your internal systems directly to the MyInvois portal, allows for easy sending of invoices in real time, and ensures compliance with IRBM regulations.

There are many secrets about e invoicing API and they will be gradually revealed in our article below. Let’s explore how API can enhance your business’s e-invoicing implementation by diving deep into our valuable words!

A Comprehensive Guide About e Invoicing API: All You Need to Know

Definition: What is e Invoicing API?

The e invoicing API (Application Programming Interface) is a technology gateway that connects your enterprise software to the Malaysian Inland Revenue Board’s (IRBM) MyInvoicing Portal. It acts as a translator, allowing your Enterprise Resource Planning (ERP) to interact directly with the government’s e-invoicing system. This connection will help automate key processes such as invoice submission, validation, and tracking, reducing manual effort and ensuring compliance with Malaysian tax laws.

The e invoicing API provides a seamless and secure path to faster, easier e-invoicing. It not only ensures compliance but also keeps operational efficiency at a minimum - a must for businesses struggling to meet e-invoicing requirements in particular and Malaysia’s fast-growing digital economy in general.

E invoicing API Detailed Components

Here’s a structured breakdown of the key components in Malaysia’s e-Invoicing system. Each element plays a vital role in ensuring smooth, compliant, and efficient invoicing operations.

Feature Block | Key Objective | Integration Points | Required Inputs | Unique Advantages |

Access Control System | Ensuring secure and verified communication | Taxpayer Login, Intermediary Authentication Endpoints | API Client Credentials, TIN, Business Details | Strengthens data protection with encrypted channels while accommodating diverse operational models. |

Invoice Template Manager | Organizing and fetching standard invoice types | Fetch Template Types, Retrieve Template Versions | Authorization Token, Template Type ID | Keeps your business compliant by providing up-to-date and regulation-approved document templates. |

Submission Workflow Processor | Managing uploads, tracking, and corrections | Submit Invoice, Monitor Submission Status, Cancel Invoice | Authorization Token, Invoice Data, Document ID | Seamlessly manages every stage of the invoice lifecycle, offering real-time tracking and effortless correction capabilities. |

Alert and Update Module | Sending notifications about invoice progress | Fetch Alerts, Retrieve Processing Updates | Authorization Token | Keeps your team informed with proactive updates, ensuring swift response to any discrepancies or delays. |

Compliance Validation Suite | Ensuring adherence to Malaysia's tax regulations | Validate Documents, Verify Compliance Standards | Invoice Metadata, Tax Details | Automatically validates invoices for tax compliance, eliminating errors and protecting against regulatory risks. |

Analytics and Reporting Panel | Providing performance insights | Generate Insights, View Metrics Dashboard | Business KPIs, Invoice Analytics Data | Delivers powerful, data-driven insights for optimizing invoicing strategies and maintaining peak operational efficiency. |

Common Types of e Invoicing API

To make your e-invoicing journey faster and more efficient, the e-invoicing API framework in Malaysia offers different types. Each type plays a specific role in the invoicing process, and it is essential for you to understand them to ensure a smooth e-invoicing journey.

- Submission APIs: These APIs ensure that your invoices are sent directly from your ERP system to MyInvois Portal in the correct format. Whether you want to issue individual or bulk invoices, this API handles the process smoothly, minimizing manual uploads that can be time-consuming or lead to critical errors.

- Validation APIs: Think of these as quality checkers. Validation APIs verify that your invoices meet all regulatory requirements set by IRBM e-invoicing. If discrepancies or missing data are detected, this API will notify you immediately so that corrections can be made before further processing.

- Status APIs: These APIs keep you informed every step of the way. Once an invoice is submitted, the status API provides updates on the invoice’s progress, such as validation, approval, or rejection status. Transparency at every step of the overall process eliminates guesswork and makes tracking faster and more accurate.

- Reporting APIs: Reporting APIs provide businesses with a holistic view of their invoicing activities. They generate detailed reports on submission trends, compliance metrics, and validation outcomes, allowing companies to track performance and identify areas for improvement throughout their e-invoicing implementation.

- Platform APIs: In addition to invoicing, platform APIs handle tasks such as authentication, notification retrieval, and document type identification. These APIs ensure secure access and make managing the invoicing process easier across various user roles and systems.

Between e Invoicing API vs MyInvois Portal: Which Differences?

When it comes to e-invoicing in the Malaysian market, e-invoicing API and MyInvois portal are often mentioned together. Which option you choose depends on the size of your business and your specific operational needs.

The detailed comparison table below written by our team of experts will help you understand the key differences between these two types of e-invoicing:

Features | MyInvois portal | E invoicing API integration |

Invoice Creation | Manual input or batch upload via Excel | Automated submission from ERP systems |

Validation Process | PDF validation with error notifications via email | Instant validation with real-time error responses |

Notifications | Sent via MyInvois and email | Sent directly to ERP systems, streamlining communication |

Invoice Sharing | Requires manual sharing with QR code for verification | Automated sharing via ERP, eliminating manual steps |

Error Handling | Requires manual re-submission for rejected invoices | Facilitates quick correction and re-submission through ERP |

Data Storage | Stored in IRBM’s database; manual retrieval by businesses needed | Accessible via ERP with automated synchronization |

Why Should You Use e Invoicing API: Top 5 Key Reasons

By leveraging the e invoicing API, you can experience the accuracy and efficiency of e-invoicing implementation, thereby revolutionizing the overall process of processing invoice transactions. The key benefits of e invoicing API below will explain this assertion more specifically.

Automation at its best: Say goodbye to manual hassles

One advantage you will definitely get when using e invoicing API: never having to retype the same invoice data again. Think about it, you are the owner of a busy retail business in Kuala Lumpur, and the number of invoices you need to process every month is up to thousands. Previously, your staff would need to manually enter invoice data into the MyInvois portal, verify compliance, and continuously check for errors. This process takes hours, risks late payments, and leaves room for human mistakes.

Things will not be so bad with e invoicing API. By integrating your ERP system directly with MyInvois, every step is automated from data entry to compliance checks. For example, the API can instantly verify Tax Identification Numbers (TINs) and flag discrepancies. All without any manual intervention. This not only speeds up the sending of invoices, but also ensures near-perfect accuracy, letting the team focus on growth strategies instead of data entry.

Real-time updates keep your business agile and informed

A story not uncommon in Malaysia: a Penang-based manufacturer needed to send an important invoice to a major customer. With the existing manual process, they had to wait hours, even days, to find out whether their e-invoices had been validated or rejected. This delay, of course, led to late payments, disrupted cash flow plans, and unhappy customers with delays in execution.

This isn’t a personal issue, as your business, if it’s not already using the e invoicing API, is probably making the same mistake.

This process will change dramatically with the API – our experts have confirmed. The e invoicing API provides real-time updates, such as “validation successful” or “error in tax code”, along with actionable details to fix the problem immediately if it arises. The transparency ensures that businesses proactively address issues, reduce downtime, and keep cash flow steady. In industries like manufacturing, where every second counts, this level of responsiveness is a game-changer.

Built for growth: Your invoicing system, ready for anything

Growth is exciting – but managing it shouldn’t be a headache. As your business expands, the need to create and navigate e-invoices increases exponentially. It’s something you should anticipate, even if it doesn’t seem as urgent as your revenue or headcount, because even a small increase in them can have a huge impact on your operations and staffing.

The e-invoicing API, in this case, should be taken into consideration from the very beginning. It is designed to keep up with the growth of your business seamlessly, capable of handling huge volumes of invoices in real time and ensuring there are no unnecessary disruptions in your operations.

Rather than being overwhelmed by high demand, these APIs provide a scalable backbone for your invoicing system. Whether processing transactions from multiple locations or integrating with complex supply chains, the API infrastructure is always reliable, no matter the pressure.

Compliance simplified: Your shield against penalties

In Malaysia, complying with e-invoicing regulations can feel like a never-ending task, especially with evolving MyInvois and IRBM standards.

“Oh, another change in e-invoicing regulations? How can my business keep up with all the other things I have to do?”, “I find it difficult to adapt to every change in e-invoicing". The whole system has to change, and sometimes I even miss the e-invoicing changes.” These complaints from Malaysian business owners, including you, will no longer arise with e invoicing APIs. E invoicing APIs simplify all the complexity, as they act as your digital compliance partner.

Here’s how: they come pre-configured to comply with Malaysia’s e-invoicing laws, seamlessly handling tasks like formatting invoices correctly, ensuring tax reporting accuracy, and submitting data in real-time. Forget about pondering over regulations or worrying about costly penalties. These APIs do the heavy lifting, so your operations are always compliant. Focus on running your business while the APIs worry about creating fully compliant e-invoices.

Seamless integration: Enhance your existing systems without overhauls

Implementing a new technology often comes with the worry of disrupting your business's current workflows. But e-invoicing APIs have the potential to eliminate this concern with seamless e-invoicing integration with ERP, accounting, or billing software. Rather than starting from scratch, these APIs act as an extension of your existing setup, enhancing its capabilities without requiring a costly system overhaul.

For example, your business using Odoo or SAP can connect an e-invoicing API to your platform to streamline your invoice processing without having to rewrite your operational framework. The plug-and-play functionality ensures a smooth transition to e-invoices, while minimizing downtime and reducing training needs for your team. It's a hassle-free upgrade that fits perfectly into your operations.

Detailed Process of e Invoicing API Implementation: Step-by-Step Guide

Implementing an e-invoicing API may seem like a rather complex and tech-heavy process. But when broken down into clear steps, it is a structured and completely doable process for any Malaysian business, big or small. Let’s get started with the steps below.

Step 1: Secure your digital certificate - key to authenticity

Before we get into the technicalities, make sure you have obtained a digital certificate (.cer or .pfx format). This certificate acts as your business’s digital signature, verifying the authenticity of your e-invoices. It’s like the official ID in the digital space.

- Where to get it: Partner with a certification authority (CA) accredited by IRBM. They will provide a certificate that is uniquely linked to your business’s identity.

- Why it’s essential: Without this certificate, your e-invoices will not be authenticated by IRBM.

- How to integrate: Once you receive the certificate, you need to install it into your invoicing system. This is typically a simple upload process, allowing your system to sign and validate each e-invoice before sending it to IRBM’s servers.

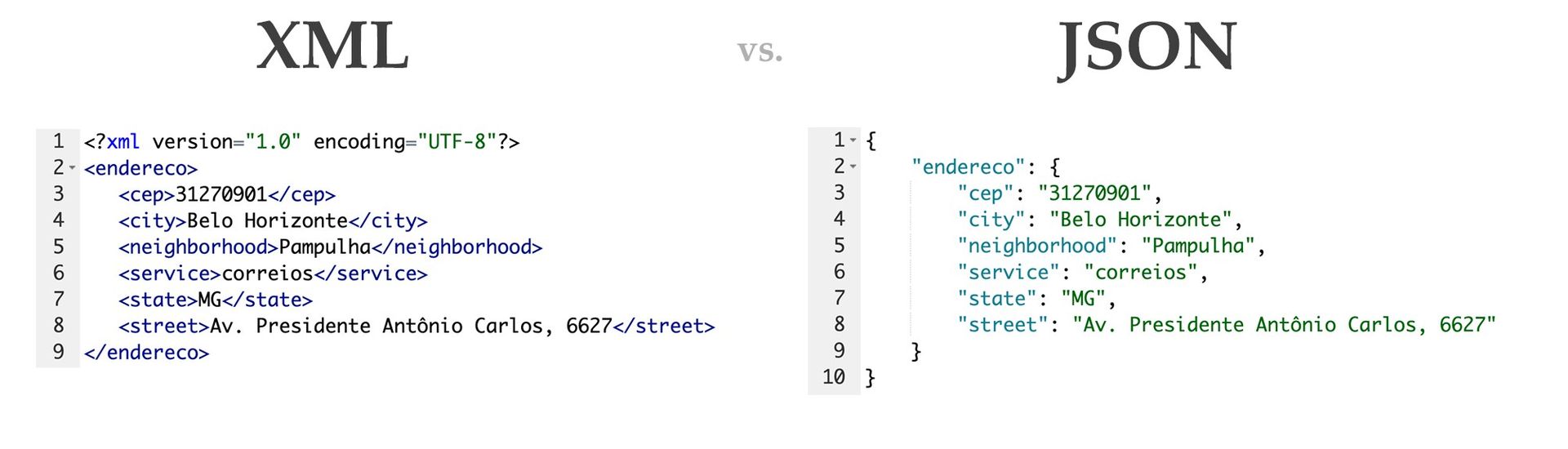

Step 2: Prepare your invoicing system - ensure it’s get to generate the correct formats

Your system must be configured to generate e-invoices in the required formats, typically XML or JSON. This is where accuracy and compliance start.

Key areas to check:

- Buyer details: Full name or company name, address, tax ID (if applicable).

- Tax information: Apply the correct tax rates and tax identification numbers to both the supplier and the buyer.

- Invoice amounts: Include itemized totals, applicable discounts, and the final amount due.

- Verification: Ensure all required fields are filled out correctly, such as invoice date, document reference numbers, and product/service descriptions. Failure to do this can result in rejected submissions, which can delay payments and cause confusion. By ensuring all invoice information is filled out completely and accurately, you are setting your business and team up for a smooth e-invoicing process without the risk of unexpected IRBM incidents.

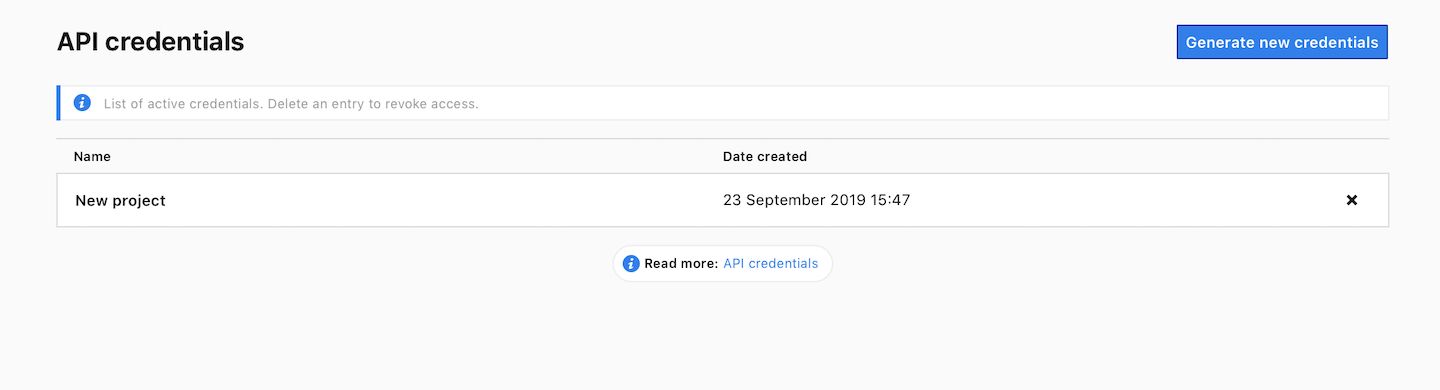

Step 3: Set up your API - the heart of seamless communication

To connect your system to IRBM’s MyInvois system, you will need to set up the API connection. This will allow you to submit e-invoices, track their status, and manage every aspect of the e-invoicing process.

- Obtain API credentials: You will need to request a Client ID and Client Secret from LHDN. These are essentially the “keys” to the digital gateway, allowing your system to communicate securely and efficiently with the government’s e-invoice platform. This request will require details like your tax identification number (TIN), business registration number, and contact information for verification purposes.

- Environment setup: Decide whether to configure the sandbox environment (testing) or the production environment (transactions). The sandbox is ideal for testing your API integrations without risking real data, while the production environment should be used for live operations.

- Configure API endpoints: You will need to set up different API endpoints to realize the e invoicing API implementation.

- Registration portal: for linking your business with IRBM.

- Invoicing portal: to submit, track, and manage invoices.

- System API: for integrating with your internal systems and validating documents.

- Document validation: to confirm that the invoices you submit meet all required standards and formats.

By following these setup steps carefully, you will ensure a secure and reliable connection to the e-invoicing system.

Step 4: Submit your first e-invoice - Accuracy is crucial

After successfully connecting to the API, the next step is to submit your first e-invoice to MyInvois for validation.

- Generate the invoice: After completing the sale, use your system to generate the e-invoice in the XML or JSON format. Make sure that:

- Buyer details are correct (name, address, tax identification number).

- Correct tax calculations applied.

- Invoice references included (such as invoice number, date, etc).

- Send to MyInvois: Once created, you need to send your e-invoices via API to MyInvois. The system will immediately attempt to authenticate.

At this step, you need to ensure maximum accuracy. Even a small data error - such as an incorrect tax number or address - can cause IRBM to reject your e-invoices, leading to delays and potential complications when reporting taxes.

Step 5: Instant validation by MyInvois - Real-time feedback

MyInvois will process your e-invoicing API almost instantly and return a validation response.

What you will receive includes:

- A unique IRBM identifier for the invoice.

- A validation date and time to track when the invoice was processed.

- A validation link to access and check the status of the invoice at any time.

In the event of an error related to the invoice, such as missing data or a formatting error, MyInvois will return an API error message that outlines what went wrong. The solution at this point is to quickly detect errors in real time and resubmit them for the system to update and proceed with the next steps.

Step 6: Send the validated e-invoice to your buyer

Once the invoice has been validated, it’s time to send it to your buyer. This ensures that they have an official, verifiable copy for their records.

- Send the digital copy: You can share an XML or JSON file directly with the buyer, or provide an image of the invoice in a more user-friendly format (e.g. PDF).

- Add a QR code: To increase buyer trust, consider adding a QR code to your e-invoices to easily verify the authenticity of the invoice via MyInvois.

Providing clear and easy access to invoices for validation is a way to take transparency to the next level and give customers more confidence in your business transactions.

Step 7: Handling rejections and cancellations - Flexibility for corrections

If a buyer discovers an error or discrepancy in an invoice, they have the option to request a rejection via the API within 72 hours.

Rejection process:

- Buyer’s responsibility: The buyer initiates the rejection process by notifying you of the issue.

- Your action: Once you receive the notification and review the error, you have 72 hours to cancel the invoice and take action to correct the issue.

- After 72 hours: After the specified 72-hour timeframe, you will need to issue a new e-invoice - typically in the form of a credit note, debit note, or refund note to adjust the transaction.

This flexibility ensures that minor errors do not cause major disruptions and that corrections can be made quickly and efficiently.

Step 8: Secure storage for easy retrieval

Once validated, your e-invoices are securely stored in IRBM’s database. However, you also need to maintain your own records for auditing and business operations purposes.

- How to store: Many businesses integrate cloud storage solutions to back up their invoices for easy retrieval during audits or reconciliations.

- Pro tip just for you: Consider storing both electronic and PDF copies of invoices to ensure maximum accessibility.

This step ensures your records remain secure and compliant, making audits and reviews over a long period of time less stressful.

Step 9: Unlock reporting and dashboards - Gain full visibility

By integrating the e invoicing API, you can also tap into advanced reporting and dashboard features that make managing large volumes of invoices easier.

- Centralized dashboard: Use the dashboard to track submission status, review specific invoices, and analyze trends in your transactions.

- Reports at your fingertips: Need to know how many invoices were processed in a week? Or check the status of a specific invoice? The dashboard gives you real-time access to this data, saving you time and effort when managing your invoicing process.

Step 10: Test, refine, and train - Perfect the process

Before going live, make sure the system is functioning as expected by performing rigorous testing in the sandbox environment.

- Identify and fix bugs: Make sure all integration points of the e-invoicing API are working correctly and resolve any issues before they directly impact your operations.

- Train your team: Once everything is tested, train your team on how to use the e-invoicing system effectively. Familiarize them with processes like handling rejections, checking statuses, and working with reports.

Proper testing and training will help your entire team be aligned and ready for a seamless e-invoicing experience.

Must-Remembered Key Notes for Successful e Invoicing API Implementation

Adopting an e-Invoicing API requires meticulous planning to avoid pitfalls. You really need our detailed and expert considerations as below to help your Malaysian businesses execute the process smoothly.

Seamless ERP and e-invoicing API integration

If your business is using an ERP system like Odoo or Acumatica, make sure it has the ability to seamlessly integrate with the e-invoicing API. You can contact your software representative to clarify this. Compatibility will ensure that invoices created with your ERP can flow directly to the API without needing manual adjustments. Custom connectors or middleware may be required to bridge incompatible points.

Also, don't forget to test the entire workflow - such as invoice creation, sending, and validation - to detect and resolve potential bottlenecks early.

Strengthened data security and privacy

Sensitive data such as tax identification numbers, invoice details, and payment information must be protected. Use encryption protocols (e.g. TLS 1.2 or higher) to protect data during transmission. Authentication using methods such as OAuth, ensure that only those with authorized access can access the e invoicing API.

Regular penetration testing and audits can help identify vulnerabilities in your system, keep it secure and comply with IRBM's strict standards.

Establish a downtime contingency plan

The e invoicing API system may experience downtime due to maintenance or technical issues. To avoid delays in operations, be aware that this is not an uncommon issue. Be patient and configure automatic retries for non-manual submissions and schedule invoice processing during off-peak hours where possible.

Additionally, contact IRBM for timely updates on scheduled maintenance, if any, and ensure your system is ready to handle outages without disrupting your workflow.

Monitor and adapt to regulatory changes

Tax regulations and e-invoicing requirements in Malaysia can evolve, sometimes unexpectedly. Assign a dedicated compliance officer or work with an advisor to stay up to date with the latest IRBM rules. Update your system regularly to stay abreast of changes such as new document types, field requirements, or endpoint adjustments. Proactively planning for updates will help reduce disruption and ensure your invoices are fully compliant.

Implement robust data storage and retrieval systems

While IRBM stores validated invoices, your business should have its own long-term storage solution. Consider integrating cloud storage platforms such as Google Cloud or AWS with advanced search capabilities to manage your invoice records. For example, indexing invoices by date, buyer, or tax category ensures quick retrieval for audits of financial analysis.

Partner with an expert e invoicing API solution provider

Navigating the complexities of e-invoicing implementation can be a challenge, especially for Malaysian businesses that do not have much technical expertise. Partnering with a certified e-invoicing solution provider ensures you have access to the tools, expertise, and dedicated support.

Customized services are provided by the professional e-invoicing solution providers: system setup, e-invoicing API integration, compliance monitoring, and staff training. Their consultation will start from your first steps into the world of e-invoicing. This partnership can significantly reduce implementation time and minimize costly errors.

Operating in Malaysia, A1 Consulting as a trusted Odoo partner, is always ready to bring superior quality e-invoicing solutions to businesses. Connected with Bizzi Invoice solution - a white-label technology that allows other providers to approach and easily move towards professional e-invoicing implementation process for Malaysian businesses, A1 Consulting with a team of e-invoicing experts will definitely bring many unexpected results for your journey to conquer e invoicing API.

Final Thoughts

In conclusion, a well-planned e invoicing API implementation not only ensures compliance but also streamlines operations, empowering Malaysian businesses to thrive in a digital economy.

Don’t forget to contact us to have custom consultation about e-invoicing implementation journey in Malaysia!