Obstacles in Implementing LHDN E-invoicing within Your Organization

E-Invoicing enhances your organization’s cash flow with an automated process helping you scale more easily. However, the shift to e-invoicing will affect everything from management strategies and organizational procedures to technical operations.

Complexities in integrating e-invoicing with existing financial and ERP systems

Rigorous adherence to IRBM's detailed e-invoicing compliance regulations

Inadequate internal resources and infrastructure for effective e-invoicing development

Difficulties in ensuring data protection and achieving real-time synchronization of financial data

We Facilitate Your Transition to LHDN E-Invoicing with Automation Middleware

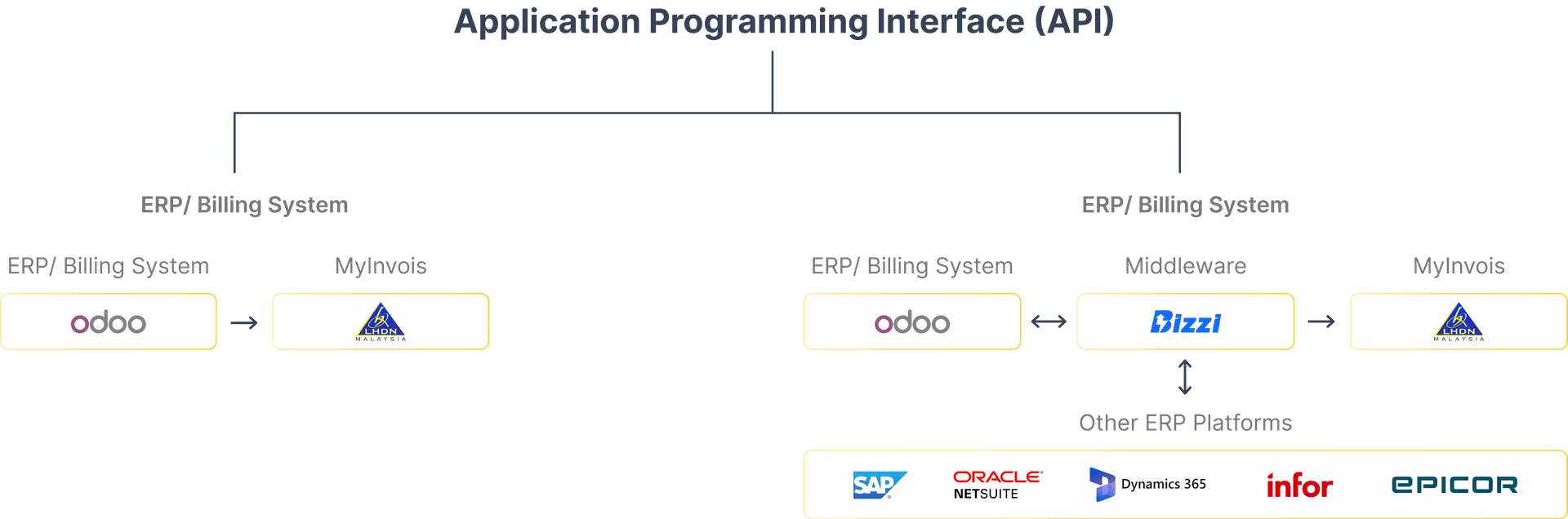

* Bizzi is a product of A1 Consulting, established with the mission of developing automation solutions by applying 4.0 technology to enhance the e-invoicing process. It can easily integrate with a serie of ERP platforms in Malaysia like Oracle Netsuite, SAP, or Epicor.

Choose Us for a Seamless, Compliant, and Future-Ready E-Invoicing Solution!

Local Expertise and Compliance

Our team, based in Malaysia, has in-depth knowledge of IRBM regulations and local e-invoicing requirements, ensuring your business stays compliant without the hassle.

Advanced Digital Transformation Solutions

Utilizing Bizzi’s cutting-edge digital transformation solutions, we accelerate your Accounts Receivable (AR) and Accounts Payable (AP) Automation processes and ensure swift integration in the fastest way with LHDN Malaysia.

Efficient Implementation and Onboarding

We streamline the implementation process, minimizing downtime and accelerating your transition to e-invoicing, so you can focus on running your business effectively.

Seamless ERP Integration

We offer smooth integration of our e-invoicing module with major ERP platforms in Malaysia like Odoo, SAP, Oracle Netsuite, and MS Dynamics 365. You don’t need to worry about compatibility with your existing systems.

Tailored Support and Customization

Our services are customized to meet the unique needs of your business, providing tailored support and solutions that align perfectly with your operational requirements.

Enhanced Data Security and Accuracy

With robust data security measures and ISO 27001:2013 in place, we ensure that your financial data is protected during the e-invoicing process, while maintaining accuracy and consistency across all systems.

80%

Faster Invoice Processing

50%

Invoice Cost Reduction Compared to Manual Process

5 Fundamental Steps in Our Roadmap to Implement E-Invoicing in Malaysia

Discover our 4 essential steps to implement your e-invoicing process with us right now!

Gap analysis for e-invoice compliance using Odoo or Bizzi integration

Action plan for addressing compliance gaps in processes and IT systems

E-invoicing automation, data updates, and API testing implementation

Monitoring of IRBM guidelines and staff training post-implementation

Continuous updates and support for ongoing e-invoice compliance

Get ahead of the competition with A1 Consulting E-invoicing Services

- A1 Consulting provides a full-service package, covering everything from system integration to training, ensuring the end-to-end e-invoicing solutions.

- Stay ahead of regulatory changes with our proactive monitoring service, ensuring your business is always aligned with Malaysia’s latest e-invoicing requirements.

- No worry about integration with existing ERP systems thanks to Bizzi's support.

- Tailor your e-invoicing solution with customizable features that adapt to your unique operational requirements, maximizing efficiency and control.

- With A1 Consulting, you get a guaranteed return on investment through improved invoicing speed, accuracy, and cost savings, backed by measurable performance results.

Looking to streamline your invoice processing with fast e-invoice conversion?

Contact us to schedule a free 2-hour consultation today

Frequently Asked Questions

From 1 August 2024, e-invoicing is mandatory in Malaysia. All invoices must be sent electronically to IRBM for confirmation and registration.

Requirements include: clearly mentioned tax invoice, sequential invoice number, invoice date, due date (if different) and payment terms.

Failure to generate e-way bills despite exceeding the turnover threshold will attract a penalty of 100% of the tax amount or Rs 10,000 for each violation, whichever is higher.

A1 Consulting's e-invoice service ensures compliance with Malaysia's mandatory e-invoicing regulations, with seamless validation and registration with the LHDN, helping you avoid violations of invoice standards and streamline your invoicing process.

E-invoicing streamlines the entire invoicing process, reducing manual data entry and errors. It automates sales order processing, data validation, accounts receivable and payable workflows, and compliance with standardized formats. This not only speeds up transactions but also minimizes paperwork, enhances accuracy, and supports seamless integration with global business partners.